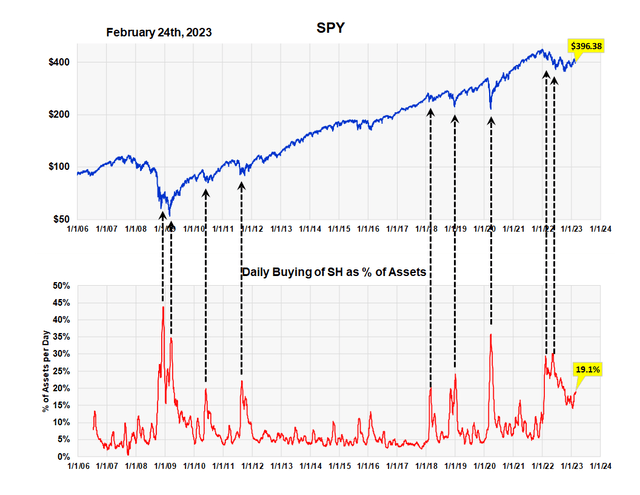

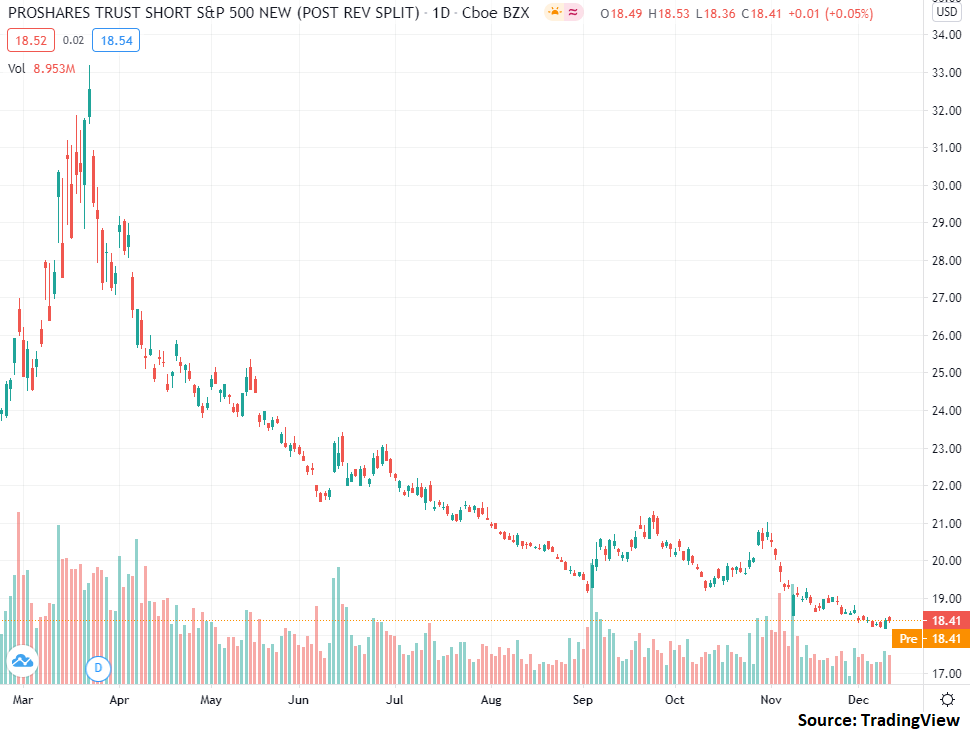

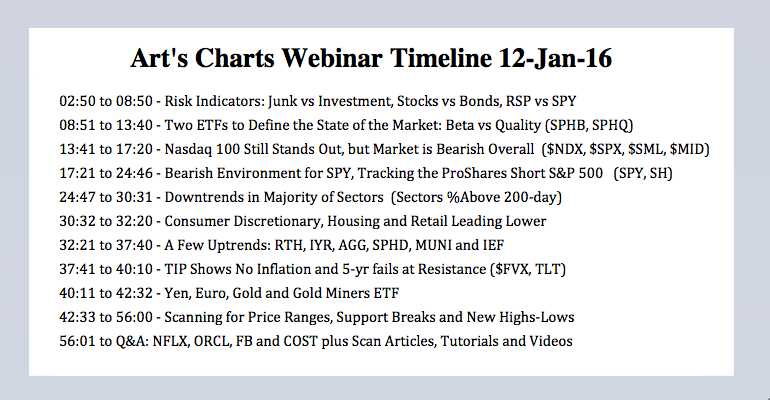

Do You Have A Systematic Process For Managing Inverse ETFs? - Erlanger Research - Commentaries - Advisor Perspectives

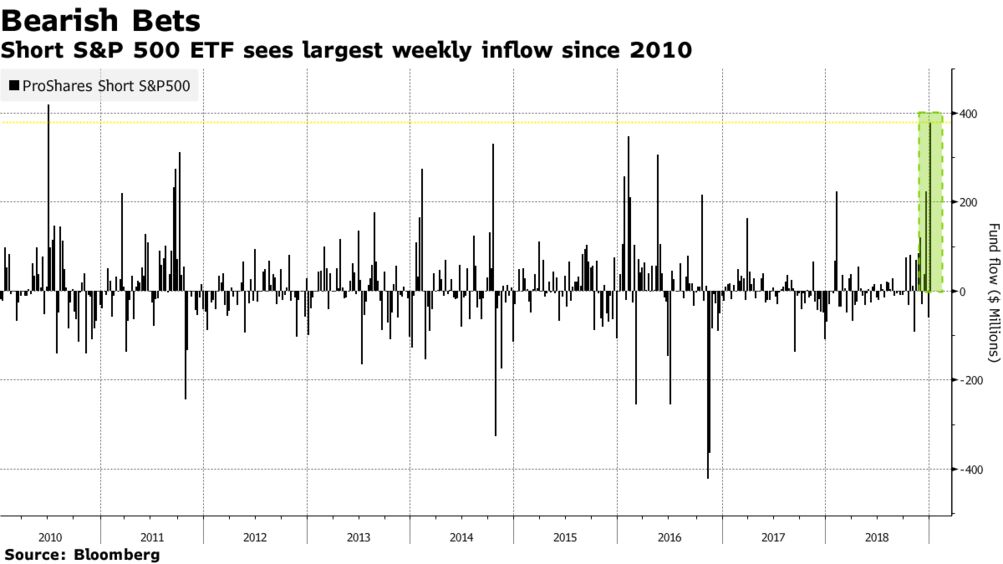

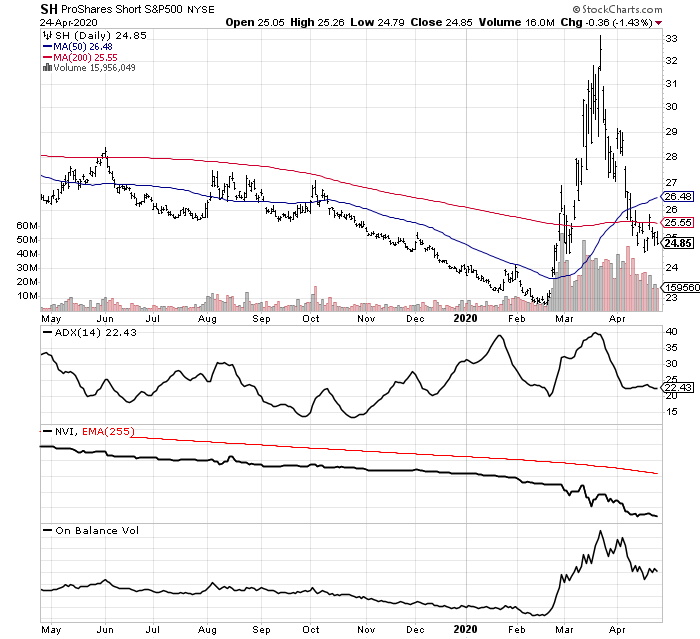

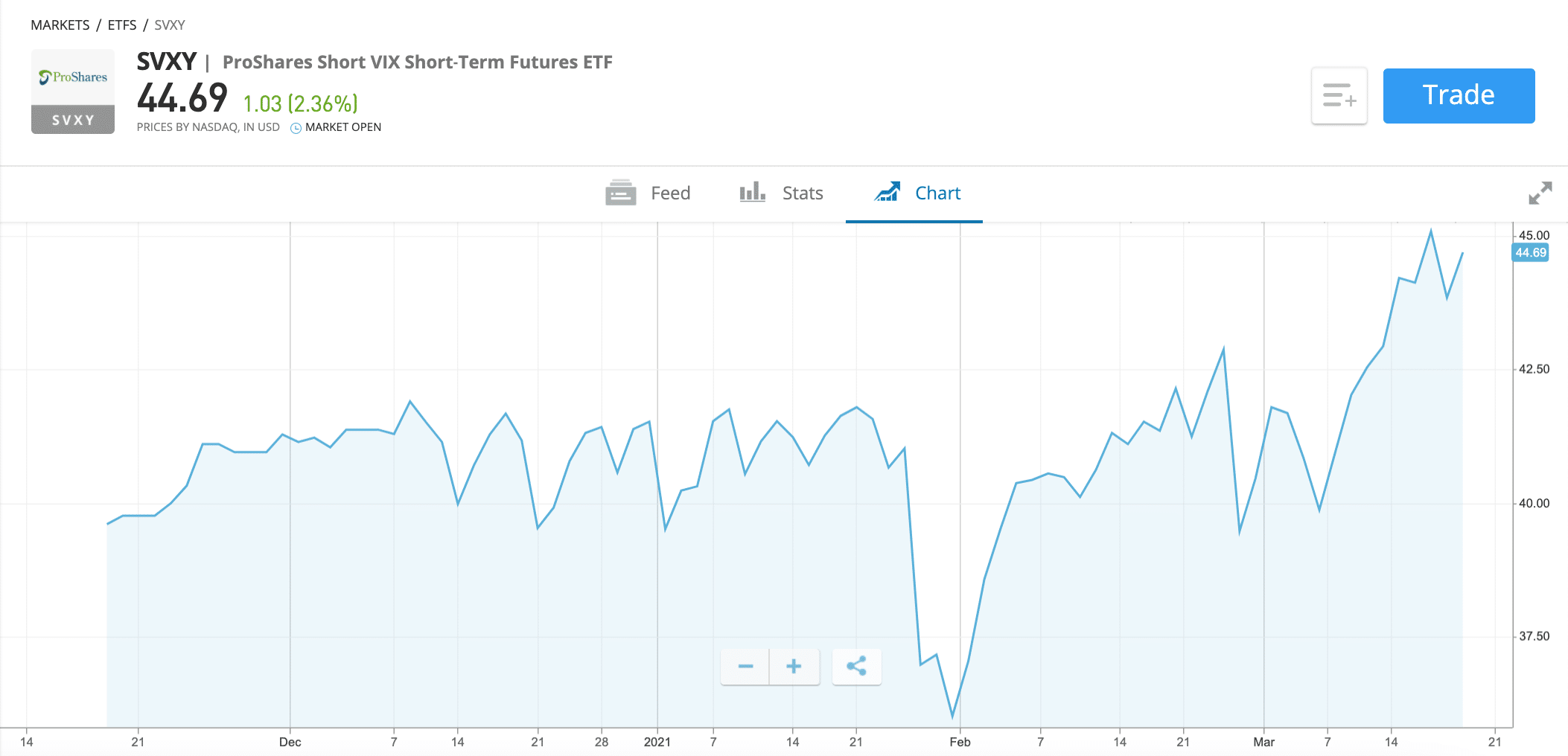

This trader sees a 43% drop for the S&P 500 and says to take shelter in these ETFs instead. - MarketWatch

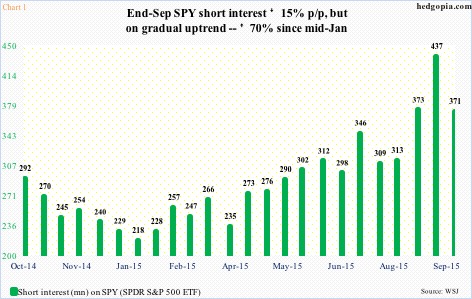

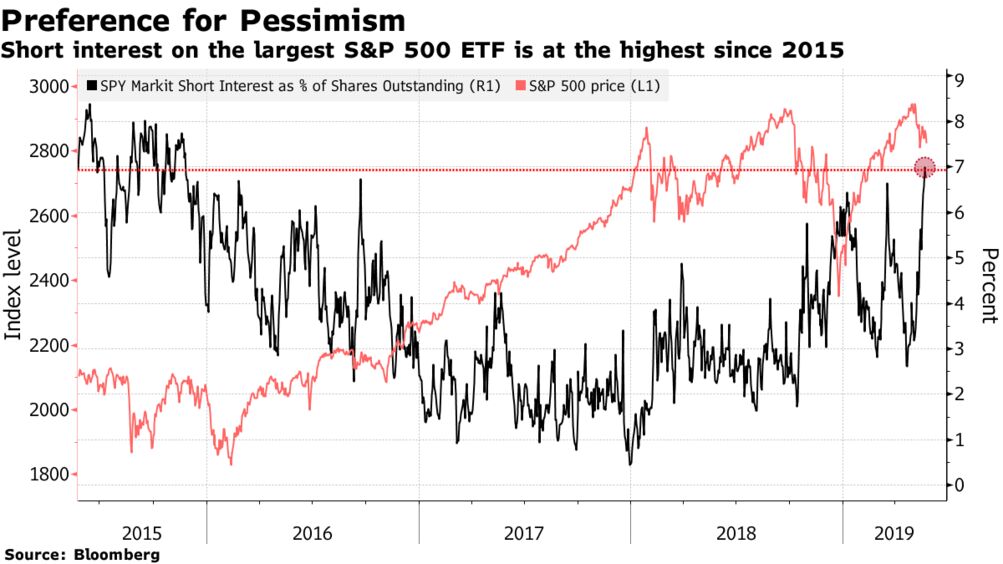

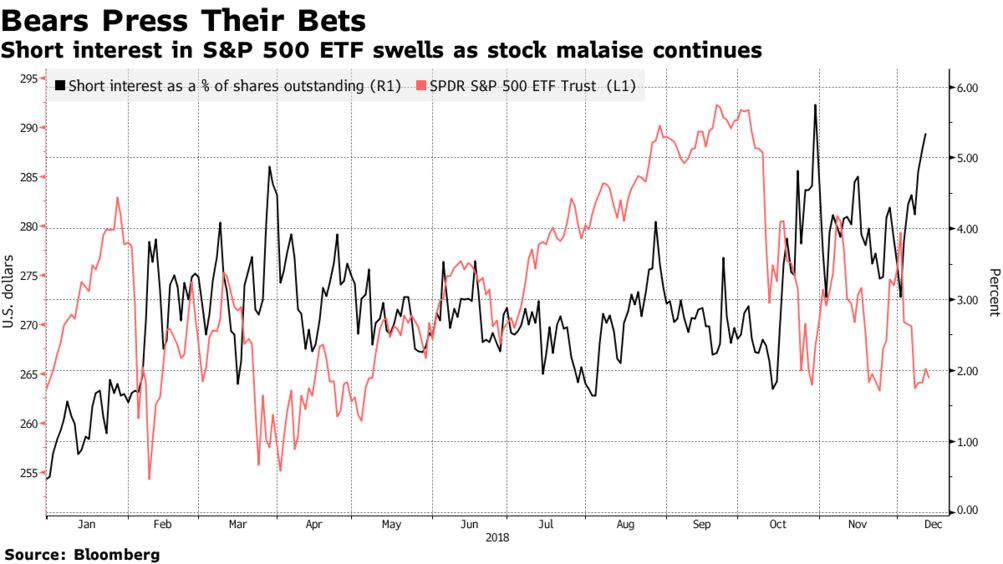

Jesse Felder on Twitter: "Short interest on the S&P 500 ETF is near the lowest since early 2007 https://t.co/2frENCtfqG https://t.co/k05Nd9zq89" / Twitter

:max_bytes(150000):strip_icc()/ap_111009073623-5bfc3831c9e77c00587a806d.jpg)